Your gap insurance coverage works by assisting pay the distinction between your lease or loan amount and insurance coverage. For instance, state you total your cars and truck in an accident. You still have actually $10,000 left on the loan, but your vehicle is worth just $4,000. In this case, your space insurance coverage can help cover the difference between the 2, as much as your policy limits. To buy space insurance coverage, you can call our representatives at $1888-413-8970 to get a quote. Your standard auto insurance coverage policy helps pay for repairs and replacement based on the real cash value (ACV) of your car. That's the quantity the cars and truck deserves on the existing market, which reduces or diminishes, as it ages.

This is where space insurance can assist you. Prior to you purchase gap insurance coverage, you should discover how much you still owe on your vehicle loan. You can then compare it to how much your car is worth. This will help you choose if you need gap insurance or not. The Insurance Information Institute likewise recommends gap insurance if you:3 Put less than a 20% down payment on your car Strategy to fund for 60 months or longer Bought a vehicle that diminishes faster than others Have already rolled over unfavorable equity from another vehicle loan Lease your automobile, which normally needs space coverage To approximate your cars and truck's worth, you require to search for the Kelley Blue Book or National Auto Dealers Association worth on your vehicle. In this manner, you can discover if it's ideal for you. Some insurers, like Geico, don't offer gap insurance, while others vary in how they use this security and how it works. https://diigo.com/0l63o8 What does liability insurance cover. Here's a quick appearance at a couple of choices: The biggest auto insurance provider in the United States, State Farm doesn't use gap insurance coverage however has actually a function called Reward Protector, which anyone getting an auto loan from a State Farm bank (an alliance with United States Bank) is eligible for. State Farm space insurance just applies wesley financial group llc reviews for complete coverage vehicle insurance coverage, however this policy doesn't necessarily have to be underwritten by State Farm.

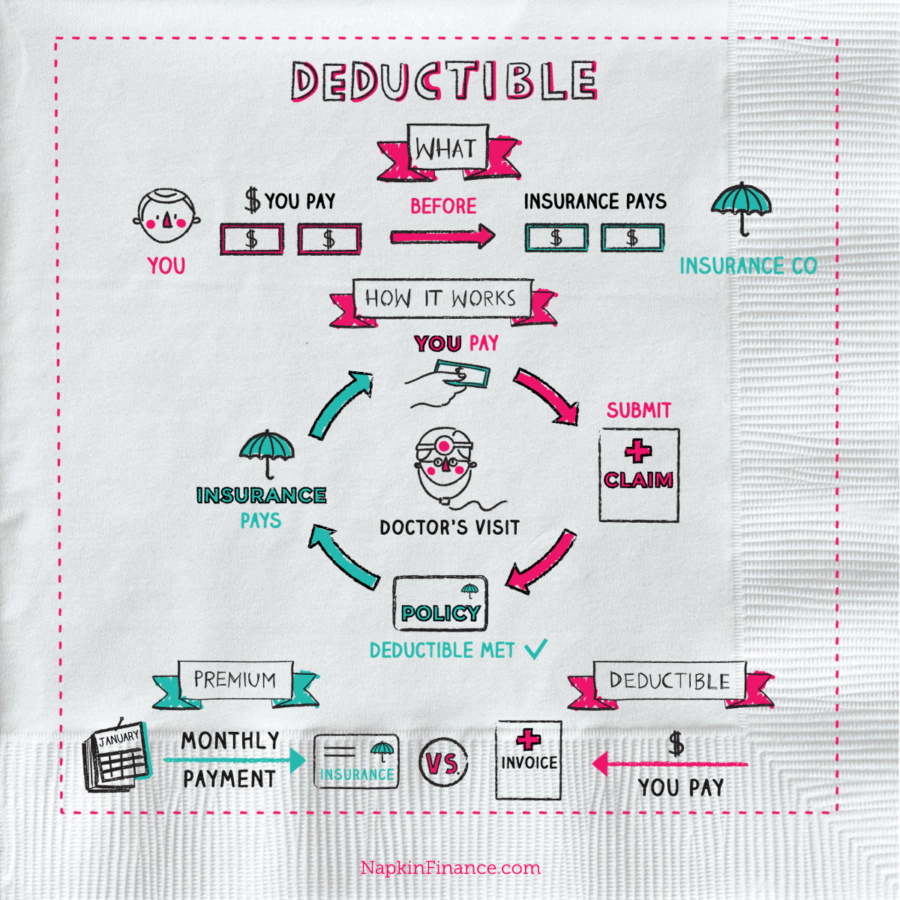

As one of the best vehicle insurance provider, State Farm makes it simple for new and existing consumers to include additional functions to their policies. The Allstate gap program waives the difference in between a main automobile insurance coverage settlement and the outstanding balance owed on a vehicle. It waives covered losses approximately $50,000 and repays a deductible payment. The deductible is the quantity you must pay prior to the insurance coverage pays the claim. Progressive caps protection at 25% of the car's actual cash value. You can get space insurance coverage bundled into your existing policy with the business for as little as $5 per month.

AAA supplies gap coverage for automobiles that are completely covered with extensive and crash insurance coverage. The insurer will waive up to $1,000 of your deductible if your car is stated a total loss. Esurance (and some other auto insurer) refers to space insurance as auto loan and lease protection. You'll get approved for coverage if you're renting or settling a funded lorry and have full-coverage insurance. USAA insurance coverage is readily available to military and military relative. USAA uses Total Loss Protection for automobiles newer than seven years old that have a vehicle loan of more than $5,000. It repays approximately $1,000 of a deductible.

For that reason, if you didn't put much money down and you still owe a sizable quantity on your overall lease payment, you'll likely owe more than the automobile is worth if you enter a mishap. It's an excellent idea to compare what you'll pay for your automobile over the life of your financing to the cars and truck's MSRP or agreed-upon sales rate and see if you have a gap from the start. In the occasion you do, gap insurance coverage is a great idea (What is a deductible in health insurance). Bear in mind your "gap cost" is constantly fluctuating. Usually, the difference between what you owe and what the automobile's worth shrinks as you make regular monthly payments and as the automobile diminishes.

3 Simple Techniques For What Is Long Term Care Insurance

If the initial loan term was short, state 3 years or less. Keep in mind to cancel the coverage once the amount owed on the vehicle is less than its value. If you're not sure of whether gap insurance is worth it, think about the expense. Gap insurance coverage is fairly low-cost and in a lot of cases can be included to your existing full-coverage policy for less than $50 annually. That's most likely far less than the shortage in between your car's worth and what you owe in case of a significant accident. Like any automobile or SUV, rented automobiles diminish quickly. Therefore, if you didn't put much money down and you still owe a sizable quantity on your overall lease payment, you'll likely owe more than the vehicle is worth if you enter into a mishap.

Similar to a bought vehicle, it's clever to compare your total cost consisting of taxes and anything else you rolled into the lease to the automobile's MSRP to figure out if you have a gap. What is liability insurance. If so, consider space insurance. And much like an acquired vehicle, the difference in between what you owe and what the vehicle's worth diminishes as you make regular monthly payments and as the car diminishes. So, you might not require the protection for Additional info your entire lease duration. You may only need it for a few months, depending on how good of a deal you negotiated. You have three alternatives for where to buy gap insurance coverage: through the dealer, a vehicle insurance company or an insurance provider.